On November 4, 2025, the Federal Government released its 2025 Federal Budget, outlining key spending priorities and new measures to support economic growth, affordability, and security. This year’s budget has three priorities: Build (major infrastructure, partnerships, and talent acquisition), Empower (reducing operating costs and building affordable housing), and Protect (sovereignty, security, and safety).

At the time of writing, the Liberal government has not yet secured approval of Budget 2025. The budget will require votes in the coming days and could be subject to negotiation or amendments before it becomes law.

In this article, we’ll break down the main takeaways — including what the budget means for individuals, families, and business owners — and how it might affect your financial planning for the year ahead.

Economic Takeaways

Here are the major economic and fiscal signals from the Budget:

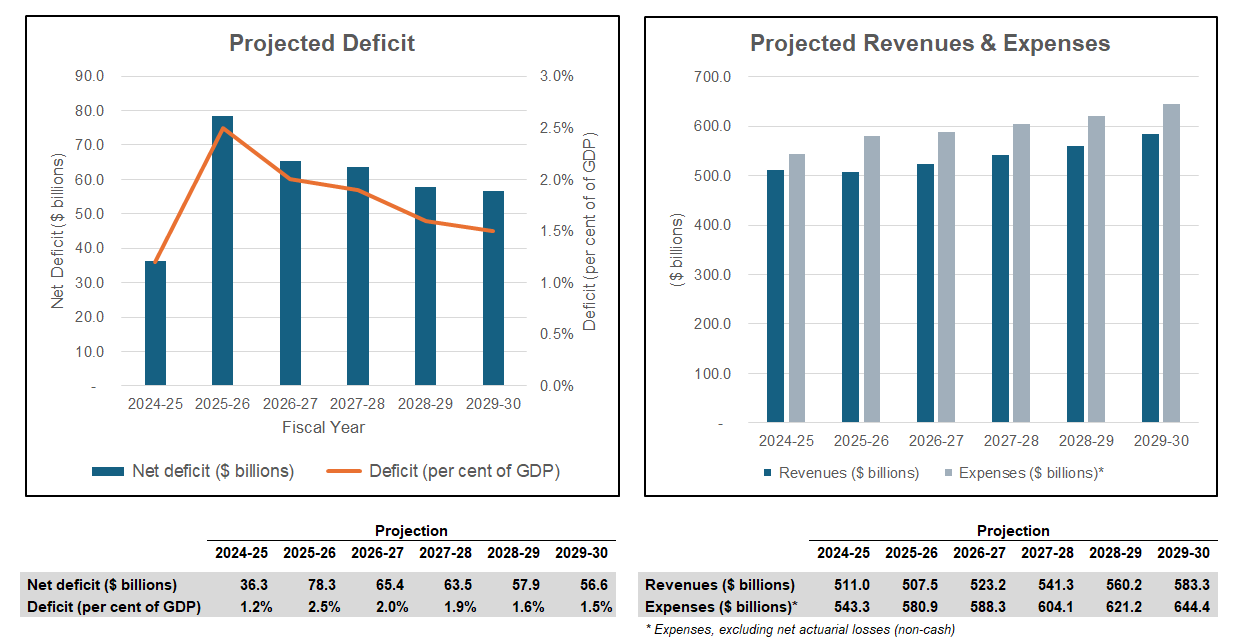

- Federal Deficit: Projected at $78.3 billion, compared to $36.3 billion last year. Decreasing to $56.6 billion in 2030.

- Deficit-to-GDP Ratio: Projected at 2.5%, compared to 1.2% last year. Decreasing to 1.6% in 2030.

- The deficit is driven by major capital investments over the next 5 years:

- Housing: $25 billion

- Defence: $30 billion

- Infrastructure: $115 billion

- Productivity & Competitiveness: $110 billion

- To fund the capital investments, the Budget proposes $58.2 billion in operating cuts over the next 5 years. This is primarily driven by the elimination of 16,000 full-time public service jobs in 2026, a total 40,000 jobs by 2029.

- The Budget does not introduce major changes to federal tax rates, and existing benefits and programs remain intact. For Canadians and families, this means no unexpected changes to personal or corporate taxes, while programs like the Canada Child Benefit, GST/HST credit, CPP and OAS continue as usual.

Source: internally generated, data from the 2025 Federal Budget

Individuals & Families

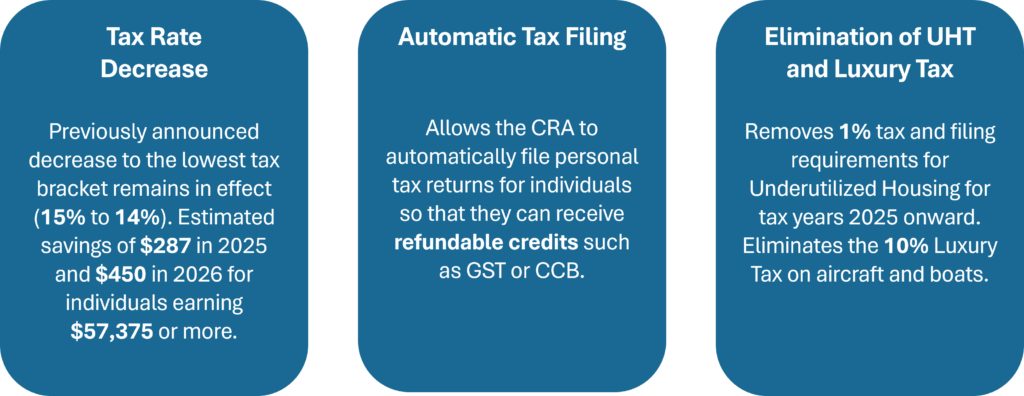

While there are no changes to previously announced tax rates, the 2025 budget introduces other measures designed to support Canadians and reduce the administrative burden of previously enacted taxes. Key highlights include:

1. Tax Rate Decrease

Effective July 1, 2025, the federal government reduced the lowest personal income tax rate from 15% to 14%.

This change applies to the first $57,375 of taxable income, meaning every Canadian taxpayer will see more money in their pocket. For the average worker, this translates to annual savings of up to $450, while a two-income family could save as much as $840 per year.

The goal: ease the cost-of-living pressures and strengthen purchasing power for middle-class Canadians. Combined with other affordability measures — such as lower fuel costs and expanded housing initiatives — this tax cut provides broad-based relief that benefits nearly 22 million Canadians.

2. Automatic Tax Filing

Automatic tax filing for low-income and non-filing Canadians is a positive step to ensure everyone receives the benefits and credits they’re entitled to.

The CRA will now be able to automatically prepare and file simple tax returns using existing income information — helping Canadians who don’t typically file because of low income, lack of access, or complex paperwork. The criteria for automatic tax filing include:

- the individual’s taxable income for the taxation year is below the lower of either the federal basic personal amount or provincial equivalent (plus the age amount and/or disability amount, where applicable);

- all income of the individual for the taxation year is from sources for which specified information returns have been filed with the CRA;

- at least once in the preceding three taxation years, the individual has not filed a return;

- the individual has otherwise not filed a return for the taxation year prior to, or within 90 days following, the tax filing deadline for the year; and

- any other criteria, as determined by the Minister of National Revenue.

The process is expected to begin in the 2026 tax season for the 2025 tax year. Individuals have the option to opt out of automatic filing and will receive a 90-day notice from the CRA to include any changes before their tax return is automatically filed.

This change is expected to help up to 5.5 million Canadians who currently miss out on refundable tax credits and benefit payments like the GST/HST Credit, Canada Child Benefit, and Canada Workers Benefit.

3. Elimination of UHT and Luxury Tax on boats and planes

The Budget removes the Underused Housing Tax (UHT) and provides targeted relief from the federal Luxury Tax, marking a shift toward simpler, more investment-friendly tax policy.

The UHT, first introduced in 2022, levied a 1% annual tax on vacant or underused residential properties owned by non-residents. Its elimination reduces administrative red tape and tax filing obligation for individuals that were effected by the legislation but not subjected to the tax.

At the same time, the 10% Luxury Tax will no longer apply to aircraft and boats, a move intended to support Canada’s manufacturing, marine, and aviation sectors. However, it appears that the tax will remain in place for vehicles valued over $100,000.

These changes streamline the tax landscape and ease compliance burdens.

Corporate Tax Measures

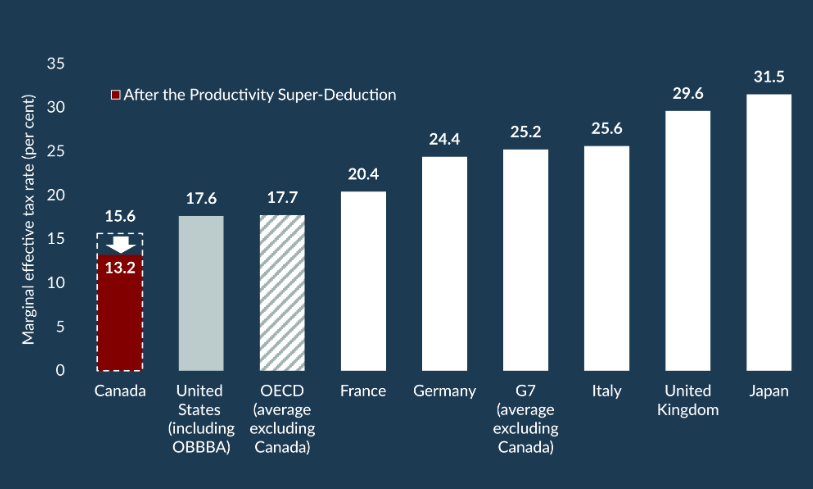

The Budget’s focus on economic investment means significant tax incentives are available to key industry players. As a result of corporate tax credits, the government aims to reduce the marginal effective tax rate from 15.6% to 13.2%, the lowest of the G7 countries.

Source: 2025 Federal Budget

While many of the corporate tax incentives target industrial, manufacturing, and R&D sectors, the federal small business tax rate remains competitive at 9%, continuing to provide meaningful savings for incorporated entrepreneurs.

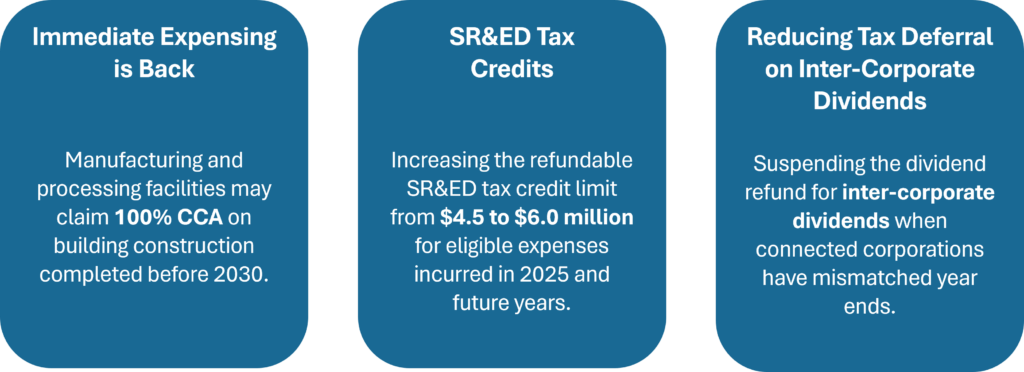

1. Immediate Expensing for M&P Buildings

Budget 2025 allows manufacturing and processing (M&P) facilities to claim 100% of the Capital Cost Allowance (CCA) on building construction started on or after November 4, 2025 and completed before 2030. This means companies can fully deduct the cost of eligible new buildings immediately, instead of spreading the expense over many years, freeing up cash for reinvestment and growth.

To be eligible for the credit, 90% of the building’s floor space must be used to manufacture or process goods for sale or

lease.

Property that has been acquired for M&P activities would also be eligible for immediate expensing only both of the following conditions are met:

- neither the taxpayer nor a non-arm’s-length person previously owned the property; and

- the property has not been transferred to the taxpayer on a tax-deferred “rollover” basis.

An enhanced first-year CCA rate of 75% would be provided for eligible property that is first used for manufacturing or processing in 2030 or 2031, and a rate of 55% would be provided for eligible property that is first used for manufacturing or processing in 2032 or 2033.

2. SR&ED Tax Credit Increase

The Scientific Research and Experimental Development (SR&ED) tax credit is being enhanced, with the refundable limit increasing from $4.5 million to $6 million for eligible R&D expenses relating to tax years beginning December 16, 2024 onward. This provides a significant boost for Canadian companies investing in innovation, technology development, and advanced research initiatives.

Enhanced Refundable Credit for CCPCs:

Canadian-controlled private corporations (CCPCs) can earn a fully refundable 35% tax credit on up to $6 million of qualified SR&ED expenditures annually.

- The $6 million limit is gradually phased out for CCPCs with taxable capital employed in Canada between $15 million and $75 million (previously $10–$50 million).

- The limit is shared among associated corporations, so businesses in a corporate group must coordinate claims.

Eligibility for Non-CCPCs:

Corporations other than CCPCs — as well as CCPC expenditures exceeding the enhanced credit limit — qualify for a 15% non-refundable tax credit on eligible SR&ED expenses.

- Non-CCPCs include public corporations, foreign-controlled companies, and any entities that do not meet the CCPC definition.

3. Reducing Tax Deferral on inter-corporate Dividends

Budget 2025 targets a loophole that allowed connected CCPC’s to defer personal taxes on investment income using multi-tiered corporate structures with staggered year ends.

How the old system worked

- When a CCPC earned investment income, it paid an additional refundable tax to approximate the highest personal income tax rate.

- The CCPC could get a refund of this tax when it paid dividends to individual shareholders or a connected corporation.

- Corporate shareholders, however, didn’t pay personal tax on dividends received from other corporations, allowing some companies to use connected corporations with mismatched year ends to defer tax for a year, or at times, indefinitely.

What Budget 2025 changes

- Suspend the dividend refund for payer corporations when the recipient corporation’s year end is later than the payer’s, limiting deferral.

- Exceptions are included for:

- Bona fide commercial transactions, such as dividends paid just before a change of control.

- Situations where the recipient corporation passes on dividends by the payer’s balance-due day, so no deferral occurs.

- The suspended refund can be claimed later once dividends flow to a non-affiliated corporation or individual shareholder.

Impact

This measure ensures that investment income is taxed promptly, preventing the use of multi-tiered corporate chains to indefinitely defer taxes. For most genuine business operations, it won’t affect normal corporate dividend flows, but it closes a timing-based opportunity used primarily for tax planning.

Final Thoughts

The 2025 Federal Budget brings a mix of targeted capital investment and long-term fiscal adjustments. While not every measure will affect all Canadians directly, it’s important to understand how these changes may influence your tax planning, investments, and business decisions this year.

If you’d like personalized advice on how the new budget impacts your financial situation, book a consultation to review your plan in detail.

About the author

Brandon helps Canadians achieve financial freedom through clear, common-sense strategies that make wealth building simple and practical.

Drawing on his CPA background, Brandon combines experience in accounting and tax, developed through work with both multi-national corporations and local entrepreneurs. He noticed a growing disconnect between the accounting world and financial advisory. This realization inspired him to bridge the gap, combining his technical tax expertise with forward-looking financial planning to offer a comprehensive experience.

Book a meeting with Brandon

Disclaimer: This article is based on proposed legislation outlined in Budget 2025 and may be subject to change. The information provided does not constitute financial, tax, or legal advice. Individuals and businesses should consult a qualified professional before making any financial, investment, or tax-related decisions.